The idea is that you should constitute a portfolio from diverse sectors to increase your chances of growth : when a given sector grows more than others you want to be a player in it, and to decrease chances of loss : if a given sector is going down you don't want to be a major player in it, you want to be a player ALSO in other sectors that are not doing that bad.

But how does DOS actually do in a world that is highly vulnerable to the big unpredictable events ? How would your diversified portfolio do when a Black Swan hits ? Would Diversification Over Sectors bring you more profits ? Would it protect you from major losses ?

We'll look at empirical facts about Diversification Over Sectors. We will look at one famous model of Diversification : Warren Buffet. We will look also at the down side, at losses, they are what matters most when trading : we don't argue that profits are better than losses, but coming back home with your initial investments is better than loosing, am I right ?

DOS and profits

We all know that in good times most of sectors grow side by side, the Dow is greener than before and everyone's happy, in other times some sectors do clearly better than others and they look like "the sector" to invest in, consider the .COM bubble, the lucky times of technology in which this sector may look like paradise.

Not willing to think much about what sectors to focus on, many people argue that Diversification Over Sectors is the answer, they give a very famous example of diversification : Warren Buffet.

Many people think that diversification is one of the key factors of Buffet's success. His companies portfolio is revealed to be "very well diversified", but how is that really helping him make money ?

I remember that I was once watching a TV documentary about Warren Buffet, what caught my attention more than anything else was something said by one of Buffet's senior employees, I regret not remembering his name but I remember him saying that even if Warren Buffet's portfolio is very diversified but the major profits come actually from a limited number of companies.

So even in one of the most cited examples of Diversification Over Sectors, it is not really helping at the diversification of sources of profits.

DOS and losses

Now let's look at the part that matters most : losses.

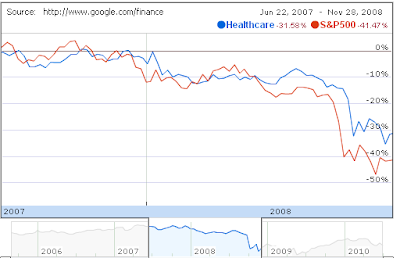

The best example I could find to prove that DOS fails in the bad times was the most recent crash of 2007. I used Google Finance to get these charts of how different sectors performed in the months that followed the beginning of the crash. Look and judge by yourself :

Basic Materials Sector

Capital Goods Sector

Conglomerates Sector

Consumer/Cyclical Sector

Consumer/Non-Cyclical Sector

Energy Sector

Financial Sector

Healthcare Sector

Services Sector

Transportation Sector

Utilities Sector

(Due to technical difficulties I will add Technology sector later)

When a major unpredictable event happened ALL SECTORS were hit very badly. This empirical proof leaves no doubt that even the portfolios based on Diversification Over Sectors were highly vulnerable to the Black Swans.

No comments:

Post a Comment